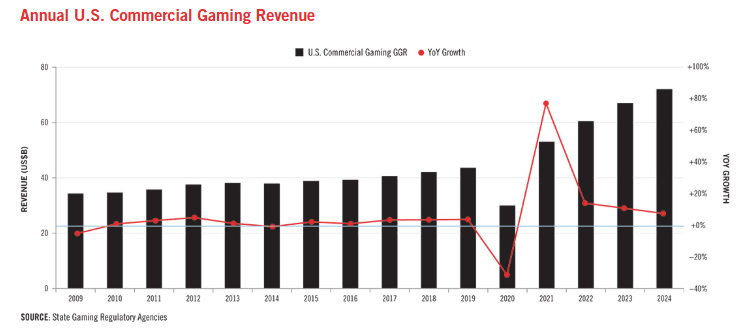

US Commercial Gaming Revenue Hits Record $72 Billion in 2024

U.S. commercial gaming operators posted a record $72 billion in total revenue for the 2024 calendar year. It’s marking a fourth consecutive annual increase and a 7.5 % rise over 2023’s $66.5 billion total.

According to the American Gaming Association’s (AGA) 2025 State of the States report, 28 of the 38 jurisdictions with commercial casinos, iGaming or sports betting operations set new all‑time annual records, underscoring broad‐based strength across the industry .

Play in the best Online Casinos

Just click on the images to register. You can find a full casino list here.

Booming Sports Betting and iGaming Verticals

The surge was driven largely by digital wagering, with commercial sports betting revenue leaping nearly 25 percent to $13.8 billion as Americans legally bet $149.9 billion on sporting events .

Online casino gaming (iGaming) likewise hit new heights, generating $8.4 billion in revenue — a 28 percent year‑over‑year gain — and enjoying record quarterly performance in Q4. Together, sports betting and iGaming now comprise roughly one‐third of total industry revenue, a dramatic shift from just a few years ago when land‑based casinos dominated.

Live (Land‑Based) Gaming Holds Steady

Despite digital’s rapid ascent, traditional brick‑and‑mortar gaming remained a bedrock, contributing $49.9 billion in revenue — a 1 percent increase over 2023 — and accounting for roughly 69 percent of total haul.

Across 492 commercial casinos, slot machines yielded $32.5 billion while table games produced $17.4 billion. Although growth in this channel was modest, several established markets — including Nevada and Pennsylvania — posted strong year-over-year upticks in casino floor performance.

Comparing Live and Online Channels

Online gaming’s 26 percent growth far outpaced live gaming’s 1 percent uptick, illustrating a dramatic realignment of consumer preferences. Digital sports betting alone grew nearly 40 percent year‑over‑year in February 2025.

In comparison, there is a 5.8% decline in slot and table‑game revenue for the same month. However, live gaming remains the larger segment by revenue share, a gap expected to narrow as more states legalize iGaming and enhance retail casino offerings.

Key Drivers Behind the Commercial Gaming Revenue Record

Industry analysts attribute this robust performance to several factors:

- Market Expansion: Two new states — North Carolina and Vermont — launched regulated mobile sports betting in 2024, immediately contributing $605.6 million in bets and bolstering national figures.

- Regulatory Evolution: Continued state‐by‐state legalization of iGaming, sports betting and daily fantasy sports has opened fresh revenue streams, attracting younger, tech‑savvy players.

- Enhanced Consumer Experience: Investments in user‑friendly mobile apps, live dealer tables, and loyalty programs have increased engagement and retention, particularly in crowded digital markets.

- Economic Tailwinds: Strong consumer spending and discretionary income in the post‑pandemic era fueled entertainment outlays, including wagering.

As the commercial gaming landscape evolves, the AGA projects that combined commercial and tribal gaming revenue could approach $115 billion in the near term, setting the stage for yet another record‐breaking year.

Also interesting

You must be logged in to post a comment.